The ongoing divorce proceedings involving Sridhar Vembu, founder and chief architect of Zoho Corporation, have taken a dramatic turn, placing the case among the most expensive divorce disputes ever reported globally. At the centre of the controversy is a $1.7 billion (approximately ₹15,000 crore) bond order issued by a California court—an extraordinary legal measure that has propelled a private marital dispute into international focus.

As of 16 January 2026, the case remains unresolved, but recent court developments have added clarity to why the dispute has escalated to such unprecedented financial proportions.

Background: A Long-Running, Cross-Border Divorce

The marriage between Sridhar Vembu and his estranged wife, Pramila Srinivasan, dates back to the early 1990s. The couple lived in the United States for several decades, primarily in California, where Zoho’s early corporate structure was established. Divorce proceedings were initiated in 2020 under California jurisdiction.

What distinguishes this case from routine matrimonial disputes is its intersection with global business ownership, private corporate structures, and cross-border assets. California follows community property law, under which assets acquired during marriage are typically considered jointly owned unless proven otherwise. This legal framework significantly shapes the present litigation.

The $1.7 Billion Bond Order Explained

The most consequential development in the case is the California court’s direction requiring Sridhar Vembu to post a $1.7 billion bond. Such orders are rare and are generally issued to preserve the status quo of marital assets during ongoing litigation.

Based on reported court proceedings, the bond requirement appears linked to:

- Concerns over asset protection and disclosure

- The complex ownership structure of Zoho and its related entities

- The risk that assets spread across jurisdictions could become difficult to secure or trace pending final adjudication

Importantly, a bond order does not determine guilt or liability. It is a procedural safeguard intended to ensure that, should the court eventually rule in favour of asset division, funds or equivalent value remain available.

Competing Legal Positions

Claims Presented by Pramila Srinivasan

According to filings referenced in media reports, Srinivasan has alleged that:

- Significant life and business decisions were taken unilaterally after Vembu relocated to India

- Certain corporate or asset-level changes potentially affected her lawful share under community property rules

- Judicial intervention was necessary to prevent erosion of marital assets

These claims form the basis for the court’s interim protective measures.

Sridhar Vembu’s Defence

Vembu, through his legal counsel, has:

- Denied any attempt to conceal or divert assets

- Asserted that his personal shareholding in Zoho is limited

- Contested the legal validity and proportionality of the bond order

- Maintained that earlier settlement discussions did not progress due to lack of mutual agreement

As of now, no court has issued a final determination validating or rejecting these competing claims.

Why This Divorce Ranks Among the World’s Costliest

The scale of the bond alone places the dispute in a global context typically reserved for:

- Founders of publicly listed technology giants

- Industrial families with multi-billion-dollar estates

What makes this case particularly notable is that Zoho remains privately held, profitable, and globally diversified. Unlike publicly traded companies, valuation and ownership stakes are less transparent, adding complexity to marital asset assessment.

While the $1.7 billion figure represents a protective bond rather than a settlement, it signals the court’s assessment of the potential size of the marital estate under consideration.

Impact on Zoho Corporation

Despite intense media scrutiny, there is no evidence to date of operational disruption at Zoho:

- Business operations continue without interruption

- No regulatory authority has indicated governance concerns

- There has been no court-ordered transfer of shares or control

Under both Indian and U.S. law, corporate ownership changes would require explicit judicial orders, which have not yet been issued.

Net Worth of Sridhar Vembu: What the Numbers Actually Indicate

Estimating the net worth of Sridhar Vembu requires caution, primarily because Zoho Corporation is a privately held company and does not disclose detailed shareholding valuations in the public domain. Unlike founders of publicly listed firms, Vembu’s wealth cannot be calculated using real-time market capitalization.

Estimated Net Worth Range

Based on multiple business publications and wealth trackers, Sridhar Vembu’s net worth is widely estimated to be in the range of USD 5–6 billion (approximately ₹42,000–50,000 crore). These estimates are derived from:

- Zoho’s reported annual revenues (over USD 1 billion)

- Sustained profitability without venture capital dilution

- The company’s global customer base and enterprise software portfolio

It is important to note that these figures are indicative, not definitive, and are subject to significant variation depending on valuation methodology.

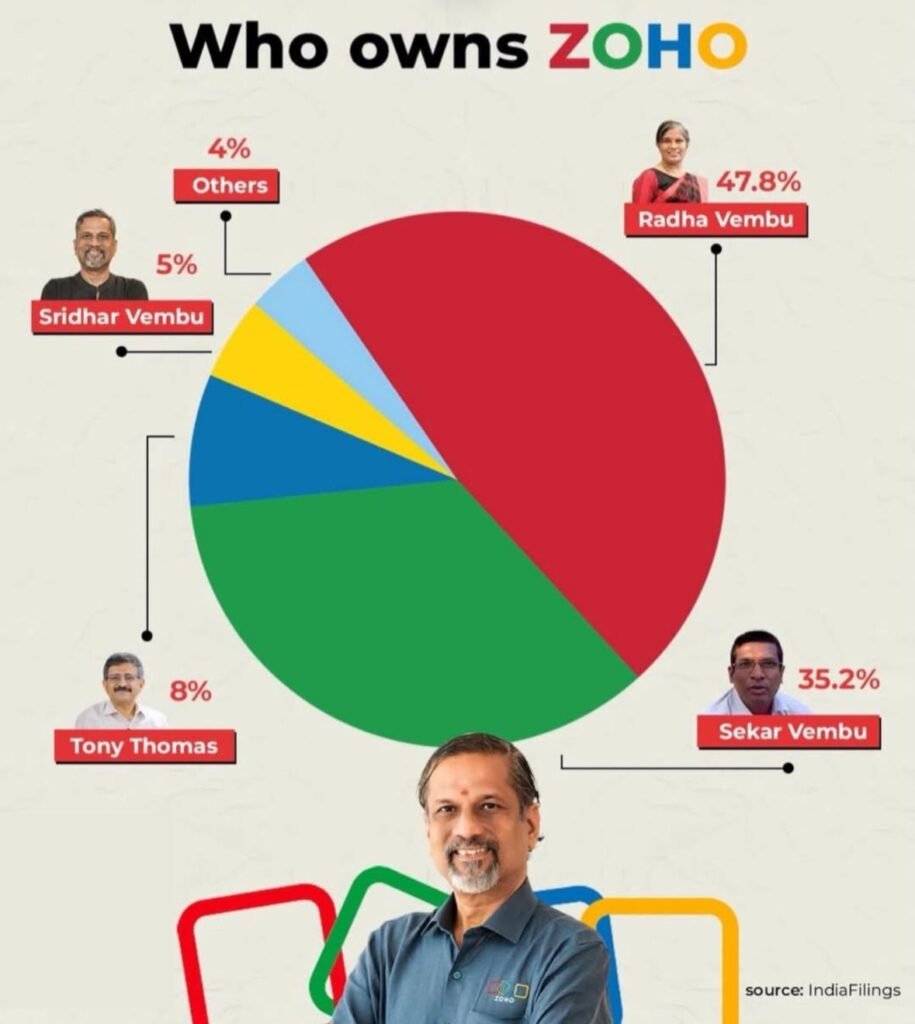

Ownership Structure and Its Implications

Zoho is known for its non-traditional ownership structure:

- The company has never gone public

- It has not raised venture capital, preserving founder and early-employee ownership

- Shares are held through a mix of Indian and US entities, adding structural complexity

In court submissions, Vembu’s legal team has asserted that his direct personal shareholding is significantly lower than commonly assumed, reportedly in the single-digit percentage range. However, courts may examine beneficial ownership, control rights, and historical asset transfers, not merely headline share percentages.

Why Net Worth Matters in the Divorce Case

Under California community property law, the focus is not solely on headline net worth, but on:

- Assets accumulated during the marriage

- The timing and nature of asset transfers

- Whether any restructuring materially affected marital claims

The reported $1.7 billion (₹15,000 crore) bond order does not imply that this amount represents either party’s entitlement. Instead, it reflects the court’s assessment of the potential value at risk while adjudication is ongoing.

Current Status as of 16 January 2026

- Divorce proceedings are ongoing in California

- The bond order remains the most significant interim judicial action

- No final settlement, asset division, or custody determination has been made public

- Legal challenges to interim orders are expected to continue

Conclusion: A Legal Case with Global Implications

Sridhar Vembu’s divorce case underscores how private wealth, global entrepreneurship, and family law intersect in high-net-worth disputes. The ₹15,000 crore bond has elevated the matter beyond a personal conflict, making it a reference point in discussions on asset protection, jurisdictional risk, and founder wealth management.

Until a final judgment is delivered, the case remains procedural, contested, and legally incomplete. However, it has already secured its place as one of the most financially significant divorce disputes of the modern era—not by speculation, but by the sheer scale of judicial safeguards now in play.